Market outlook August 2025 – Higher prices, but less uncertainty

The stock market reached a new record high in July, boosted by strong results from the large technology companies.

We maintain a credit overweight and a neutral weight on equities in the market outlook for August. Returns have been strong since the bottom after "Liberation Day" in April. The stock market reached a new all-time high in July, lifted by strong results from the major technology companies.

The stock market rose to new heights in July.

The negotiations between the EU and the USA ended with a tariff rate of 15 percent. The result was better than feared and removed a significant uncertainty in the market. The mood was also lifted by the earnings season. Around 70 percent of the companies in the S&P 500 index have reported numbers for the 2nd quarter, and collectively they have surprised on both revenue and earnings per share. It is particularly the heavyweights in technology and artificial intelligence that have surprised positively, and the price development in these has lifted the market in July.

Global stocks rose 1.4 percent measured in U.S. dollars. A strengthening of the dollar throughout the month meant that the return was 3.1 percent measured in Norwegian kroner. The strongest sectors were technology and energy, while healthcare and consumer stocks performed weakly. The rise on the Oslo Stock Exchange was more moderate, but the fund index OSEFX rose 0.6 percent despite a 20 percent correction in the Kongsberg group. Norwegian stocks are up 15 percent so far this year, while global stocks are up just under one percent measured in Norwegian kroner.

The return in Credit was also good. Both Nordic and global high-yield bonds rose around 1 percent secured in Norwegian kroner. The return in Bonds was around zero percent due to capital losses on government bonds (interest rates rose). This has been reversed at the beginning of August.

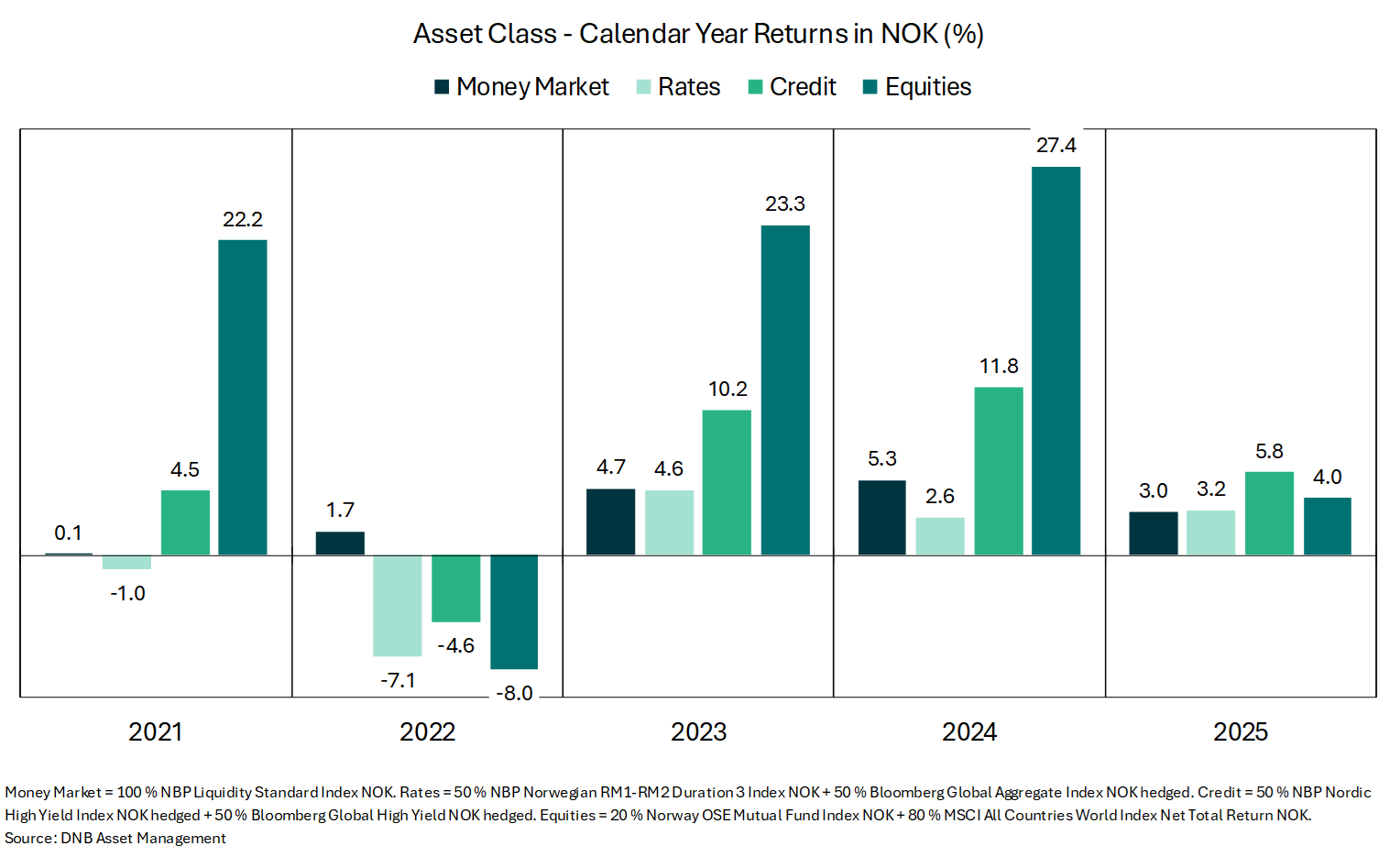

Measured so far this year, the return in our benchmark index for Credit is stronger than for Stocks, while Bonds and Money Market have provided nearly equal returns as shown in the figure above.

Market view August

The strength of global growth has declined, but the climate for owning risky assets is still satisfactory. Liquidity is good; interest rates have been cut as price growth has come down towards the target and credit spreads have been reduced. Investments in artificial intelligence and defense are also moving in a positive direction.

The introduction of tariffs is negative, but the level is manageable and uncertainty has decreased. The cost will be shared between the consumer through slightly higher inflation and importers/exporters through reduced margins. Some of the effect may be moderated if the dollar strengthens. Companies with global supply chains that import goods or components to the USA will be hit hardest (consumer stocks), while the large technology companies are less exposed.

We make no changes to the market outlook at a general level. Equities remain at neutral weight. Credit and Bonds are overweight, financed by an underweight in Money Market.

The content of the article is to be considered as marketing material from DNB and should not be perceived as an offer to buy or sell financial instruments or as investment advice tailored to the individual investor's situation. DNB assumes no responsibility as a result of the content of the article being the basis for any investment decisions. Historical returns are no guarantee of future returns. Returns may be negative as a result of price losses.