Large disparity between the winners and losers in the tech sector

There have been significant fluctuations in stock prices, and we cannot say that OpenAI's GPT-5 model lived up to expectations, says portfolio manager Erling Thune for the DNB Technology fund.

It has been a turbulent period for the technology sector this year. Apple, a company that the managers of DNB Technology have long been underweight in, has dropped nearly 25 percent in the first seven months of 2025, while Microsoft has risen 15 percent measured in Norwegian kroner.

“The statements made by Sam Altman from OpenAI about the capabilities of ChatGPT 5.0 in ‘Vibe Coding’ caused many of the large and established software providers to fall. We believe the market is overreacting when it comes to certain types of software companies. I don’t think it’s that easy to sit in your bedroom and vibe-code an SAP system,” says Erling Thune, one of five portfolio managers in the equity fund DNB Technology.

In the long term, AI is expected to replace some knowledge-based jobs, and many software models are based on “seat-based pricing.”

Very demanding and complex

– This could have long-term effects, so it makes sense that the multiples go down somewhat. Many new AI-based companies are emerging that challenge the big ones, but it is very demanding and complex, he continues.

Vibe Coding is programming where one uses generative artificial intelligence from A to Z. DNB's programmers have also experimented with this, and they have reached the same conclusion: It is too early to let go of the wheel just yet.

– There is a race to have the best ecosystem around large language models. For now, only OpenAI has revenues to speak of, and even they have opened parts of their language models, says Thune.

Our largest position has provided a pleasant return

The managers have long focused on "hyperscalers", meaning those who make money from setting up data centers. Within this, they have invested selectively where they find the greatest value.

– Our largest position Microsoft has provided a pleasant return, and their cloud business grew almost 40 percent in the last quarter, largely driven by their facilitation of the use of ChatGPT, says Thune.

He also points out that Western Digital has good demand growth for storage, particularly from cloud providers, relatively tight supply, and good progress in the development of the next generation of hard drives.

– We are still in the early phase of cloud services and artificial intelligence, which we believe provides a strong foundation for growth going forward, says Thune.

The stock is a significant underperformer

– Apple delivered quite solid quarterly figures driven by iPhone sales, although part of it was due to "stockpiling" before the introduction of tariffs. The increase in the stock price came actually as a result of the announcement that they plan to invest 100 billion dollars in semiconductor production in the USA. The market interpreted this as them being treated more leniently when the tariffs are implemented. It also helped that CEO Tim Cook at Apple presented Trump with a gold bar on live TV, says Thune.

– Apple rose after the quarterly figures were released, and we had bought a bit more of the stock beforehand. The stock is still down so far this year and has been a significant underperformer, so it has been right to stay away from it for large parts of the year.

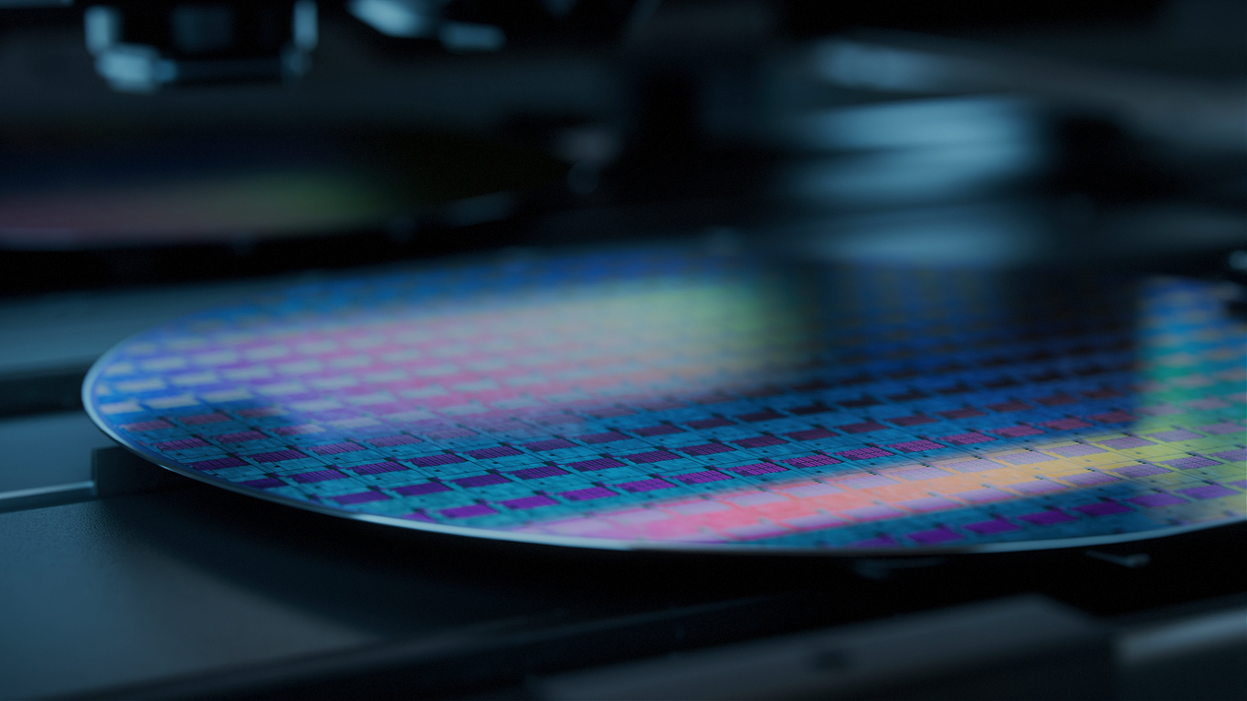

Semiconductors have also been a mixed bag, but overall this group of companies has risen quite a bit in the first 7 months of the year. SK Hynix, NVIDIA, Samsung are among the winners this year.

– SK Hynix and Samsung have been positive contributors so far this year for the fund. The latter reported good progress in memory with high bandwidth and signs of improvement in the markets for traditional memory chips, says Thune.

He mentions that Nvidia was bought into the portfolio after the steep fall earlier this year, but is still a significant underweight in the fund.

Weak in Nokia and Ericsson

– Nokia has fallen as they downgraded their profitability outlook due to currency effects and the effect of US tariffs. Ericsson is actually quite solid and both stocks now appear very cheap, says Thune.

Thus, there is still a dynamic and changing picture in the technology sector where there is a large spread between the winners and losers.

– We continuously adjust our positions, trimming if the stock prices have gone up a lot or increasing if we find attractive opportunities, concludes Thune.